Frequently Asked Questions

Find answers to all your questions below and ways we can assist you!

Have Questions about Dynamic Systems?

-

How long will my order take?

3-10 business days depending on circumstances

New or changes to an existing check order, a proof will be emailed in 1-2 full business days. *Any order placed after 2pm EST is counted for the next business day*

This can take longer if the proof fails our inhouse proofing process.

Orders only go into production once proof is approved.

Repeat orders that do not require a proof will ship within 3-4 business days.

Custom or larger orders may take longer.

Stock Items such as envelopes or blank check stock will ship within 1-2 business days.

Shipping times varies on location- can be anywhere from 1-5 days

You will be notified by e-mail when your order ships. Please allow time for Standard Ground delivery.

-

If I select overnight shipping, will I receive my order the next day?

No. Expedited shipping only applies to when the order is ready to ship.

-

What is the difference between M/P, A/P, or P/R check?

- M/P = Multipurpose- a check you use for both Accounts Payable and Payroll

- A/P = Accounts Payable or Operating Account

- P/R = Payroll Account

-

If I select rush production when will my order ship?

Rush Charges are applied to orders that require a faster production time than our standard estimated 3-4 business day turnaround

Same Day Rush - $50 (subject to availability) · Order must be submitted and/or approved by 2 pm Eastern time · Order will ship same day

1 day Rush - $40 (subject to availability) · Order must be submitted and/or approved by 2pm Eastern time · Order will ship the next working day

2 day Rush - $30(subject to availability) · Order must be submitted and/or approved by 2pm Eastern time · Order will ship on the second working day

-

Can I provide a bank letter with my routing and account number?

No. In order to process your order, we must have an actual sample check with your correct MICR line OR a MICR Specification Sheet filled out From your bank (see below)

-

Why do I need to provide a sample of a voided check or MICR spec sheet?

A voided check or a MICR specification sheet is needed to ensure your checks do not fail when scanned at the bank institution.

The MICR line (routing and account #) read like a barcode and fit into very specific spaces based on your bank requirements. The voided check or MICR spec sheet will show what spaces your bank requires.

-

What type of file is required for logo’s?

Please upload a high-resolution file of your logo. Logo's will be printed in grayscale.

Allowed File Types: JPG, PDF, EPS, AI, TIF, BMP

Maximum File Size: 1000 KB -

What is the difference between M/P, A/P, or P/R check?

M/P = Multipurpose- a check you use for both Accounts Payable and Payroll

A/P = Accounts Payable or Operating Account

P/R = Payroll Account

-

How do I print my checks?

Any questions related to printing checks or alignment issues should be directed to the software company.

-

Can I make changes to an order already placed?

As long as the order has not been printed, changes can be made. Please contact us at info@dswebtoprint.com or call 1-800-782-2946 to speak with a customer service representative. Have your order number or customer number ready.

Once an order is printed, no changes can be made.

-

How is my order shipped?

All items sent to the 48 contiguous states or District of Columbia are sent FedEX ground. All other locations are shipped Priority Mail.

-

Which areas do you ship to?

Dynamic Systems ships to all 50 states, Puerto Rico, Canada and Virgin Islands. We do not ship to military APO/FPO addresses, P.O. boxes.

-

How are charges calculated?

Our shipping and handling charge is compensation for costs related to processing your order, including the handling, packaging and delivery of the products you have purchased. Shipping cost is based on a product's weight, delivery destination and level of service.

-

What are my payment options?

We accept Visa, Mastercard, American Express and Discover. All online credit card orders are secure. You card is not charged until your order ships, usually within 3-5 business days.

-

Where do I call or email for assistance?

Our representatives are happy to assist you - simply call 1- 800-782-2946

Monday - Friday 8:30AM – 4:30 PM EST.

Email us at: info@dswebtoprint.com

Have Questions About Tax Forms?

-

How many transmittals do I receive with my order?

3 transmittals are sent with every order. If you require more, please be sure to let us know when placing your order.

-

How do I determine the number of forms to order?

When ordering your forms be sure to take into account not only your current employees but also employees that were hired for a specific project or were seasonal. Also, consider any additional forms you may need due to loss or damage from postal mis-handling.

-

How do I order the right quantity?

When placing your order with Dynamic Systems order the number of forms you need not the number of sheets. If you order 50 forms, you will receive enough forms for 50 employees.

-

What is the difference between a 4-Up W2 and a 4-Part W2?

A 4-Up W2 is a ‘condensed’ W2 format used for employees. This means that all the parts necessary for the employee to report are on one single sheet. The single sheet is perforated into 4 sections with each section used for the employee to report earnings (Copies B, C, 2 and 2). A 4-Part W2 refers to a set of forms (both employee and employer copies) used to report in states such as FL, TX and TN where there is no state or local withholdings.

-

What is the difference between 4-Part, 6-Part and 8-Part W2 forms?

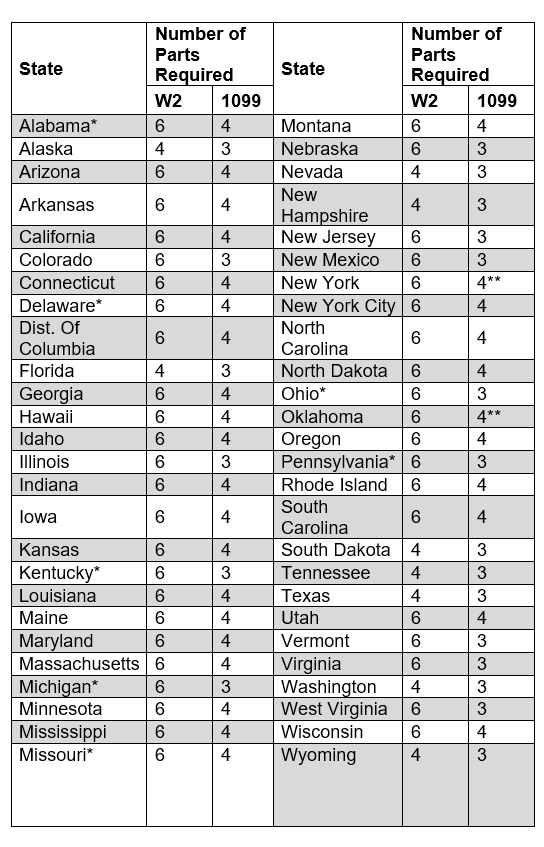

Your state and locality determine the number of parts necessary for you to report. A 4-Part W2 is used in states where there is no local or state withholding. 6-Part W2 forms are used when there is state, but no local withholding to report. 8-Part W2 forms are used when it is necessary to report federal, state and local withholdings. If you are unsure of the number of parts necessary for your organization to purchase, please contact our tax form team.

-

Can I return my tax forms?

Tax Forms are time sensitive, dated materials. We do not accept returns after December 1st.

-

What are the Tax Form Requirements per State?

*Certain cities in Alabama, Delaware, Kentucky, Michigan, Missouri, Ohio and Pennsylvania will require an 8-part W2.

**Requires 5-part 1099 MISC.